Bizcommunity.com

Decades of consistent investment in infrastructure have been instrumental in fostering and preserving a robust base of engineering expertise within South Africa, particularly among consulting engineers. Andrew van Zyl, managing director of SRK Consulting, emphasises the pivotal role of consulting engineers in upholding exacting standards in project planning and execution. These professionals offer highly specialised technical and strategic services across various industries.

Van Zyl elaborates that their independent contributions fortify project quality and ensure clients, whether from the private or public sector, receive value for money. The relative resilience of the mining sector has kept the company busy in recent years, owing to its extensive history in this sector, Van Zyl added.

Upward trajectory

“However, it is really only a sustained and upward trajectory of broader economic growth that will secure South Africa’s vital skills base in the consulting engineering sector,” he said. “It is becoming an urgent necessity that public sector spending on infrastructure rises and stabilises; this will support the creation of a firmer foundation for the country to maintain and further develop its expertise among consulting engineers.”

He emphasised that the quality of the consulting engineering industry in any country relies on the steady growth of experience across multiple disciplines over decades, not just years.

“Here in South Africa, we have been struggling to generate and retain these skills,” he noted. “Many specialisations are in high demand internationally, so we are also competing with other countries for these scarce skills.”

Highs and lows

The mining sector was by its nature cyclical, and this created regular fluctuations in the demand for specialised consulting engineering input. This often made it challenging for companies to retain and foster the expertise required by mines, especially during commodity price slumps.

It was therefore important that other sectors of the economy were also vibrant, so they could help to temper the highs and lows of the commodity cycle.

“Buoyant commodity prices in recent years have kept consulting engineers very busy – with considerable scarcity in some disciplines,” he said. “However, the construction and infrastructure sector remains subdued, and this has depressed the demand for important skills that the infrastructure sector will need in the long term.”

Returning to the vital role that consulting engineers play in both the public and private sectors, he said these experienced professionals provide independent advice on how to plan and implement quality engineering solutions for a modern economy.

Nurturing best minds

“The disciplines underpinning these solutions take decades to nurture, and invariably demand some of the best students that the educational system can generate,” said Van Zyl. “We need to be cultivating these skills and interests among the country’s best students, which means supporting students and mentoring graduates.”

He highlighted that, in practice, this could only be successfully accomplished in a growing economy that can make full use of this expertise, and where careers can be built.

“It should be remembered that consulting engineers really drive the implementation of global best practice in a range of sectors that must compete on the international stage,” he said. “Only by keeping up with these global benchmarks can South Africa’s economy remain competitive and aligned with the expectations of investors and regulators.”

Evolving mandate

The mandate of consulting engineers is also evolving, he pointed out. Today, it is necessary not only for engineering structures to be technically sound, cost-effective and safe, but they must also be environmentally and socially responsible. These latter aspects of projects are now an essential requirement for businesses to operate globally.

“This approach also ensures that economic development occurs within a sustainable and responsible framework – including complying with legal regulations and other compliance requirements,” he said.

“By applying these factors, consulting engineers contribute to building an inclusive and job-creating economy; at the same time, they help ensure that business is transparent and predictable – which are important considerations for investors.”

In line with these trends, SRK has built its expertise in the environmental, social and governance (ESG) field, including issues like climate change resilience, water stewardship and decarbonisation. The consulting engineering field has also embraced the opportunities offered by digital technologies, with SRK investing in its data science capabilities to enhance the application of scientific and engineering skills.

Van Zyl noted that the consulting engineering sector was resilient, and despite years of underspending in public infrastructure, South Africa still retained a high level of skill and capability that in many respects compared well globally.

South Africa’s freight and logistics market booming

Bizcommunity.com

South Africa’s freight and logistics market is expected to grow rapidly in the coming years, driven by the growth of e-commerce and development in outlying areas. The market is expected to contribute $21.53bn to the economy in 2023, while online retail sales are expected to contribute more than double that amount at $46bn within two years. City Logistics CEO Ryan Gaines says that these factors are significant for the country’s booming logistics sector.

“This growth is evident not only in the frequency of truck deliveries, but in warehousing investments required to accommodate the demand. The retail sector in particular is seeing a volume growth of 6% year-on-year,” he says.

The April 2022 floods across KwaZulu-Natal meant the province experienced the greatest growth as companies normalised their operations. Cross-border truck loads also rose with Namibia, Lesotho and Botswana showing a 10% increase and Eswatini recording 18%. Gaines says the company has served nearly 1,000 new stores in South Africa during 2023 as existing retailers opened new facilities.

Boosting capacity

He adds that the industry can anticipate further amalgamations as South Africa prepares to service global giants like Amazon and traditional brick-and-mortar retailers expand their e-commerce platforms and offer more door-to-door deliveries. In 2022 City Logistics, in partnership with private equity company Clearwater Capital, for example, purchased the Fastway Couriers franchise in South Africa. The company had acquired the Fastway Cape Town and Durban businesses the previous year.

The move strengthened its last-mile delivery offering, effectively having the option for consumers to have packages conveniently delivered to their door rather than travelling to a store or designated pick-up point.

Last mile logistics partner crucial

“It is the most imperative aspect of the delivery process. This element of the logistics chain is rapidly gaining importance as the retail industry keeps up with the increasing consumer demand for speedy shipping, specifically in e-commerce.”

Airbnb commits to making tourism more inclusive, sustainable in Africa

Bizcommunity.com

Airbnb has pledged $500,000 to support inclusive and sustainable tourism in Africa over the next two years. The pledge will help governments and tourism organisations identify new opportunities, support hosts and guests, empower entrepreneurs, and support investment in the tourism ecosystem.

The pledge was announced at the Africa Travel Summit and follows the launch of the Economic Impact Report, which shows that Airbnb contributed more than R23.5bn to the South African economy in 2022.

Build a more inclusive tourism economy

Velma Corcoran, regional lead of Middle East Africa at Airbnb, says: “This pledge is an important demonstration of Airbnb’s continued commitment to a truly sustainable, diverse and inclusive tourism industry – a travel economy for all. We believe in the power of public and private sector partnerships to support this important work, and we look forward to working together with governments, non-profits and tourism organisations across Africa to make travel and hosting more accessible, safe, diverse, and affordable for everyone.”

Through the Africa Pledge Airbnb will help countries across Africa with:

Investment in the tourism ecosystem

• Airbnb will support economic empowerment, digital access and sustainability in the region. Airbnb will also work with local stakeholders to identify organisations that should be considered for awards, with grants distributed by its community fund.

Identifying and unlocking tourism opportunities

• In 2024, Airbnb will publish an Inclusive Tourism Growth White Paper to support countries in Africa in identifying opportunities across tourism and policy that will drive inclusive and sustainable tourism across the continent.

• Airbnb will also provide access to its city portal – a first-of-its-kind resource for local governments and tourism organisations – to an additional 10 African countries to deliver data, insights and tools to local authorities and tourism organisations to better understand the Airbnb landscape in their communities and unlock tourism opportunities.

Supporting hosts, guests and communities

• In partnership with destination marketing organisations, the company will develop local host and guest guides to help hosts improve the visitor experience and encourage guests to be good visitors.

Empowering the next generation of tourism entrepreneurs

• Airbnb will expand its entrepreneurship academy to five new countries over the next two years.

Available in South Africa and Kenya, the academy is an entrepreneurship development programme focused on introducing individuals from diverse and underrepresented communities to hosting on the Airbnb platform in coordination with local community partners.

Governments, destination marketing organisations and non-profit organisations that are interested in finding out how they can be included in this pledge can contact Airbnb.

Germany is willing to spend on Nigeria energy

Bizcommunity.com

German Chancellor Olaf Scholz said on Sunday his country was willing to invest in gas and critical minerals in Nigeria, Africa’s largest oil producer, as he started a two-nation visit to sub-Saharan Africa.

This is the third visit to the region by Scholz in two years and comes as conflicts elsewhere highlight the growing importance of an energy-rich region in which Berlin has traditionally had little involvement.

“There is a willingness to invest, especially in critical minerals,” Scholz told reporters at a joint briefing with Nigerian President Bola Tinubu in the capital Abuja.

On gas, he welcomed Nigeria’s efforts to expand its LNG capacity.

“If we are successful, if there is a better chance of exporting the produced gas … it is then the question for German companies to do their private business,” said Scholz.

Tinubu said he had “a very deep discussion” on the issue of gas and encouraged German businesses to invest in pipelines in Nigeria.

Nigeria is also seeking to woo investors to its mining sector, which has long been underdeveloped, contributing less than 1% to the country’s gross domestic product.

Without giving details, Scholz said there was also a willingness from German companies to build railways in Nigeria. That sector is currently dominated by Chinese companies, which have won contracts to expand rail lines in Africa’s biggest economy.

Scholz also met the president of the commission of West African regional group ECOWAS and said it was necessary to work with the bloc “to prevent that putsches will become a trend” following recent military coups in Niger and Gabon.

IFC gives $2.9bln to East African green economy businesses

The East African

The International Finance Corporation (IFC) has given Kenya, Tanzania and the Democratic Republic of Congo (DRC) businesses $2.9 billion in long-term and short-term financing.

Mary Porter Peschka, IFC Regional Director for Eastern Africa, said it gave $65 million to fintech platform M-Kopa Holdings in Kenya to expand its financial services to under-banked consumers.

The fund aims to increase access to finance for small businesses, boost energy access and drive gender inclusion.“IFC increased its investments in Eastern Africa by 61 percent in the last financial year and this financing is supporting our partners to increase lending to small businesses, expand access to green and sustainable electricity, and drive greater gender inclusion,” Peschka said.

Read: Pan-African insurer in renewed push for continental investment“IFC aims to grow its work across Eastern Africa even further this year to support the region’s development agenda and the private sector’s role in building the foundation for a more inclusive and green future,” she added.

This is helping to increase access to productive assets such as solar home systems, smart phones and e-bikes, making them more accessible to customers.

IFC provided a $150 million loan to KCB Kenya to support businesses tackle the effects of climate change, with focus on financing the development of energy efficiency projects, renewable energy, climate smart projects, and green buildings.

In Tanzania, IFC launched ‘Anaweza: She Can’, a $10 million programme to empower more women across Tanzania to access financing, attain leadership positions in the private sector, and launch or grow businesses, including in agriculture.

IFC’s programme aligns with the Tanzania Development Vision 2025, the National Five Year Development Plan III (2021/22-2025/26), Zanzibar Development Vision 2050, the National Gender Policy and its Strategy, and the Tanzania commitments on Generation Equality, which outlines steps to enhance human capital, empowerment and gender equality.

The IFC invested $10 million in Nuru to expand access to renewable energy through mini-grid systems in the DRC. Nuru’s utility-scale “metro-grids” use cutting-edge technology and service, designed to provide reliable, round-the-clock renewable energy to communities in Eastern DRC.

Once completed, the installation at Bunia will be the largest off-grid solar hybrid project of its kind in Sub-Saharan AfricaSérgio Pimenta, IFC Vice President for Africa, said the lender had funded African investments to the tune of $11.5 billion between July 1, 2022, and June 30, 2023, across 40 countries.

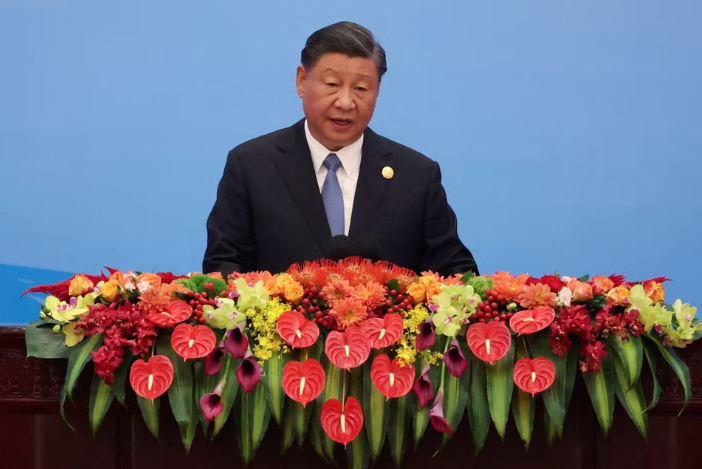

China’s Xi Jinping commits to more investments in Nigeria

By Felix Onuah

ABUJA, Oct 19 (Reuters) – China’s President Xi Jinping pledged on Thursday for his country to increase investments in Nigeria’s power generation sector and its digital economy, the Nigerian vice president’s office said in the wake of a Belt And Road Initiative forum in Beijing.

Nigeria’s National Agency for Science and Engineering Infrastructure (NASENI) and three Chinese partners signed contracts for new projects valued at $2 billion, Vice President Kashim Shettima’s office said.

It added that another $4 billion worth of letters of intent was received for new projects and investments in different sectors of the economy.

Nigeria is seeking to attract investments to boost sluggish growth in Africa’s biggest economy, which is saddled with mounting debt, high inflation and unemployment.

The agreements signed include vehicle assembly projects, solar products, vehicle design and production, drone technology transfer, clean energy utilisation and the development of an industrial park.

Nigeria also signed contracts with China Harbour Engineering Company for the construction of the Lekki Blue Seaport in Lagos.

Shettima met Xi, who asked for the protection of Chinese workers in Nigeria, according to the vice president’s office.

China had committed to rail projects in Nigeria in the past and to a seaport in Bonny Island in the Niger Delta. But the projects are still waiting for loan disbursements after securing approvals from China Exim Bank and Nigeria’s parliament.

At the Belt And Road Initiative Forum, China also committed to refinancing the completion of two rail projects that stalled due to a cut in China’s funding commitments. China had earlier agreed to provide 85% of the financing for the rail projects.

ITME Africa 2023 to equip & enhance Kenya’s Textile Production Prowess

Africa Business

India ITME Society, a non-profit apex industry body successfully concluded the “Curtain Raiser & Preview” of the 2nd edition of ITME Africa & Middle East 2023 on Tuesday 3rd October 2023, to be held one month hence from 30th November 2nd December 2023 at Nairobi, Kenya.

Left to right Mr. Richard Cheruiyot, Board Chairman of the Export Processing Zones Authority (EPZA); Ms. Ruth Wadenya Ouma, Partnerships Manager, Kenya Chamber of Commerce & Industry (KNCCI); Mr. S. Hari Shankar, Imm. Past Chairman, India ITME Society; Mr. Ketan Sanghvi, Chairman, India ITME Society; Dr. Juma Mukwana, Principal Secretary, State Department for Industry, Republic of Kenya; Mr. Didier Moussa Lombe, Deuxieme Conseiller, Ambassade De La Repubiluque Demmocratique De Congo Au Kenya; Ms. Adina Devani, Honorary Consul, Bosnia & Herzegovina; H.E. Shri Rohit Vadhwana, Deputy High Commissioner, High Commission of India; Mr. S Senthil Kumar, Hon’ Treasurer, India ITME Society;Mr. Giuseppe Manenti, Director, Italian Trade Commission; Ms. Seema Srivastava, Executive Director, India ITME Society.

ITME Africa & M.E. 2023 was conceived with a Vision to initiate a new era towards self reliance, socio-economic advancement & empowerment in the Textile & textile Engineering Sector with International co-operation for Africa & Middle East. Also it nurtures a Mission to serve as a gateway for Textile Technology & Engineering inclusive of technical Education, Skill Development, Investment, Joint Ventures & Sourcing with a sustainable and long term goals.

Despite an enormous untapped potential for trade expansion with Africa & M.E, presently trade with these regions are limited to certain sectors only. There is an enormous potential & opportunity presently with all elements aligned favorably for surging forward towards national economic prosperity and finding successful place in the global trade. Modernization and innovative technology is the only way forward for Industry & business to succeed in today’s world.

With over 80 years of development and fastest growing economy with growing Textile Technology in African continent, Kenya is in the right path to become Africa’s Textile and Apparel Hub. As the host country for ITME Africa 2023, Kenya being a prominent country of African Union & active member of AFTA can be the pivot for Textile Technology & Engineering Industry for the whole of African continent.

This once in 4 years event in Nairobi, Kenya is an effort to promote joint venture and business cooperation for Textile & Machine manufacturers which can act as a catalyst towards modernization of African Textile Industry & explore potential of Kenya as a new business destination along with other 23 participating countries other than India, Egypt, Ethiopia, Germany, Ghana, Italy, Jordan, Kenya, Nigeria, Rwanda, South Africa, Spain, Sri Lanka, Taiwan, Togo, Turkey, Tunisia, Uganda, Unites States of America & Zambia.

With this, it shall strengthen its position as a pioneer in modernization of its textile industry and position itself as a pivot for Textile technology upgradation for Africa & M.E. focusing on new chapters such as

- Cotton Seed & Cotton Farming Technology & Equipment,

- Machinery related to Engineering Products,

- Home Textile Products

- Associated Goods and Services for Textile Industry

- Technical Information Services, Educational Research Institutes & COE’s

| At this curtain raiser event the Guest of Honor H.E. Shri Rohit Vadhwana, Deputy High Commissioner & DPR (UNEP & UN-HABITAT), High Commission of India, Nairobi said, “This Exhibition is a significant stride towards enhancing bilateral trade and promoting industrial cooperation between India & Kenya. This landmark partnership aims to harness the strengths of both nations and drive innovation, sustainability, and economic growth in the Textile Technology & Engineering sector.” |

| Chief Guest H.E. Dr. Juma Mukwana, Principal Secretary, State Department forIndustry, Republic of Kenya stated, “ITME Africa & Middle East 2023 hosted in Kenya shall draw more attention to the potential of the Kenyan textile industry and raise awareness about their products and capabilities, both domestically and internationally. This can lead to increased visibility and potential business inquiries and open doors for Kenyan businesses to expand their customer base.” |

| Mr. Ketan Sanghvi, Chairman India ITME Society said, “With 23 Countriesconverging in Nairobi under the banner of India ITME Society, Africa will benefit tremendously in sowing the seeds for future partnership & successful business in African Continent.” |

Immediate Past Chairman Mr. S. Hari Shankar emphasized that “Latest & efficient technology is the only factor which gives economic success & trade dominion both domestically and globally”. Newly elected Hon’ Treasurer Mr. S. Senthil Kumar drew attention to the benefits of sector specific business exhibition for focused growth of the textile industry.

Various Govt schemes, facilities & incentives available for foreign companies were shared at the curtain raiser by Mr. Richard Cheruiyot, Board Chairman, Export Processing Zones Authority (EPZA) invited industry to take advantage of facilities at EPZA and Ms. June Chepkemei, Acting Managing Director, Kenya Investment Authority, Ms. Ruth Wadenya Ouma, Partnerships Manager, Kenya Chamber of Commerce & Industry emphasized the strengths of Kenya to provide most friendly business environment for doing business with Kenya.

Approximately 30 plus mainstream media covered the event. Other esteemed dignitaries who enriched the networking event with their active interaction with invited guests included H.E. Ms. Winpeg Moyo, Ambassador, Republic of Zimbabwe, Ms. Adina Devani- Honorary Consul, Bosnia & Herzegovina, Senator Mr. Omwami Sande Oyolo, Mr. Didier Moussa Lombe, Deuxieme Conseiller, Ambassade De La Repubiluque Demmocratique De Congo Au Kenya & Mr. Giueseppe Manenti, Director, Italian Trade Commission. Business leaders from Indian diaspore in Kenya, Officials from Gatsby Africa & Commercial attachés from multiple embassies interacted & networked with a promise for continued and detailed interaction during the main event ITME Africa & Middle East 2023 scheduled from 30th November to 2nd December 2023.

ITME Africa & Middle East 2023 is designed to foster a conducive business environment, promote textile & technology exchange and provide necessary infrastructure support to facilitate the same. ITME Africa & Middle East 2023 shall bring together whole lot of possibilities to Textile businesses, Institutes, Students, Associations, Banks, Investors, Technology Consultants, & Trainers, Exporters / Dealers & Agents. A new set of Supply chain can create many Entrepreneurship / Start-up opportunities.

It is an unique and most promising event of 2023 for Textile Industry hosted in Kenya bringing plethora of opportunities to the doorstep of African Continent.

Participate and experience the wind of change and beginning of a new journey for textiles in Africa.

Seema Srivastava

Executive Director

India ITME Society

Egypt’s Suez Canal Economic Zone signs energy deals worth up to $14.75bln

Reuters News

DUBAI – Egypt’s Suez Canal Economic Zone has signed a deal worth $6.75 billion with China Energy for green ammonia and green hydrogen projects to be established in the Sokhna Industrial Zone, a cabinet statement said on Tuesday.

It also signed deal with Hong Kong-listed United Energy Group to establish a potassium chloride production complex with an expected investment of up to $8 billion, the statement said.

South African manufacturing output rises 1.6% y/y in August

Reuters News

South Africa’s manufacturing output rose 1.6% year on year in August after rising by a revised 2.2% in July, statistics agency data showed on Thursday.

Factory production was up 0.5% month on month in August, after falling by a revised 1.7% in July.

Egypt, Belarus mull building electric buses factory in Alexanderia

Arab Finance

Arab Finance: Egypt is looking forward to establishing a factory for manufacturing electric buses and trucks in Borg El-Arab, Alexandria, in cooperation with Belarussian companies, a statement by the Ministry of Trade showed on October 10th.

This has been discussed during a meeting between Minister of Transport Kamel Al-Wazir and the Belarusian Ambassador to Cairo Sergei Terentiev to discuss potential cooperation in several transport fields.

During the meeting, they probed collaboration between Belarus, the Holding Company for Maritime and Land Transport, and the Holding Company for Roads, Bridges, and Land Transportation Projects to revamp both companies’ workshops.

This includes providing the two firms with the latest equipment, maintaining, and scaling up the efficiency of their truck fleets, and converting their workshops into maintenance centers.

El-Wazir said that his ministry has been taking all the necessary measures to implement the presidential directives on the localization of the bus industry in Egypt.

Furthermore, both parties discussed the possibility of establishing a center for grain production at an Egyptian port to meet the local market’s needs and export to Africa.