Africa’s GDP has recovered strongly in the last year, but the impact of the COVID-19 pandemic and the Russia-Ukraine conflict could pose considerable challenges in the midterm. This is according to the 2022 African Economic Outlook, by the African Development Bank.

The report released on Wednesday shows that Africa’s gross domestic product grew by an estimated 6.9 percent in 2021. This is after the continent suffered a pandemic-induced contraction of 1.6 percent in 2020.

Rising oil prices and global demand have generally helped improve Africa’s macroeconomic fundamentals, the report found. But growth could decelerate to 4.1 percent in 2022, and remain stuck there in 2023, because of the lingering pandemic and inflationary pressures caused by the Russia-Ukraine crisis. Both countries are major grain suppliers to Africa.

The African Development Bank Group has responded to the likelihood of a looming food crisis with a $1.5 billion African Emergency Food Production Facility approved by the Group’s executive board last week.

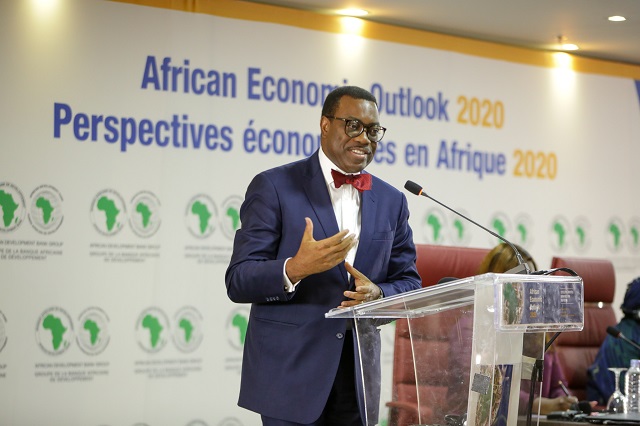

AfDB president Dr. Akinwumi Adesina said international efforts, including those of the African Development Bank Group, the G20 Common Framework for Debt Treatment, and the $650 billion in Special Drawing Rights issued by the International Monetary Fund, are supporting the continent’s recovery.

However, he said the recovery will still be costly.

“Africa will need at least $432 billion to address the effects of COVID-19 on its economies and on the lives of its people — resources it does not have,” Adesina said.

The 2022 African Economic Outlook proposes a series of policy recommendations to build back better and engender resilient economies in Africa.

Proposals include speeding up COVID-19 vaccination and delivering strong support to domestic pharmaceutical industries; reducing reliance on single food sources, and revisiting global debt frameworks.